Call Don today: 951-533-4966

Blog

Topic Archives: Business Operations

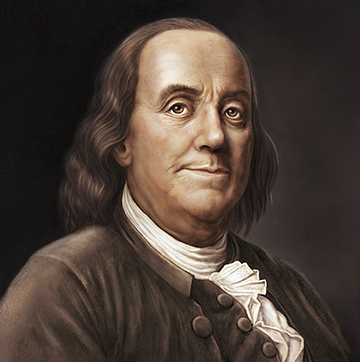

I was recently reading a list of famous quotes from Ben Franklin when I was struck by how timeless much of his advice is. While the business world has changed tremendously, these truths about business success have not.

“If you would know the value of money, go and try to borrow some.”

Borrowing money for your business is not easy. For example, according to Biz2Credit’s October 2016 Small Business Lending Index, in October 2016 big banks approved just 23.5% of small business’ loan requests, small banks approved 48.7%, alternative lenders approved 59.5% and institutional lenders approved 63.1%. In other words, 37 to 76% of applicants got turned down.

As I’ve written about before in “Is Your Loan Package Ready for the Spotlight ,” lenders are quite picky about what loans they’ll approve. Managing your cash flow is therefore vital. Making the most of the cash you have minimizes your dependency on lenders.

“Remember that credit is money.”

Maintaining a strong credit rating is like having cash in the bank. Businesses extend credit to those who pay their bills on time. If you can prove your creditworthiness, vendors will be more likely to give you favorable terms, and lenders will be more likely to approve your loan requests.

Of course, you also need to be aware of the flip side of this issue. Do something to wreck your credit worthiness, and you can quickly find yourself unable to access the money you need to run your business.

“Beware of little expenses; A small leak will sink a great ship.”

On one level, this advice gets back to the need to have a budget and financial controls in place. But on another level, this is about managing the mentality and culture.

For example, one area that’s often out of control is office supplies. There’s a storeroom stocked with a nine-month supply of paper and pens. Employees are allowed to “redecorate” their desks with designer in-baskets, and soon everyone wants to personalize their workspace in this way. You get the picture.

While excess spending on office supplies probably won’t sink the ship, this “no limits” attitude will quickly spread to much bigger expenses...and before you know it, your bottom line really is affected.

Conclusion

Want to augment Ben Franklin’s advice with the advice and counsel of an experienced CFO? Give me a call! As a part-time CFO, I’m here for you.

Fall is in the air. Which means that it’s time for football…falling leaves…and your annual corporate check-up. What exactly is a corporate check-up? It’s a chance to review what took place over the past year, take a hard look at actual versus plan, assess your company’s overall health, and get ready to start planning for the next fiscal year.

How do you conduct a corporate check-up?

Schedule a meeting with senior management, including your company’s CEO, COO, CFO and VP Marketing/Sales. Distribute copies of this year’s strategic business plan (you do have an annual strategic business plan, right?), and have a frank discussion about the following:

• Did you achieve the goals that you laid out in your plan? Why or why not?

•Did your implementation plan turn out to be workable and realistic? If not, what happened that you did not anticipate?

•Did new, unforeseen opportunities arise? If so, did you succeed in taking advantage of them? Why or why not?

•Did you have the right employees to allow your company to succeed?

•Did you have the necessary working capital to grow and thrive? Where do things stand now?

•How strong were your relationships with your major vendors? Where do these relationships stand now?

•How solid were your business processes and IT systems? Did any issues arise?

•Were you able to provide formatted financial reports that everyone from senior management to outside lenders understood and had confidence in?

•Did you make use of weekly dashboards to more effectively manage your business?

The answers to these questions will help you assess the business’ health and inform your strategic business plan for next year. In analyzing the answers, pay close attention to patterns in the things that the company seems to be doing right and areas in which you need to improve. What are the underlying causes of the problems you faced? For example, if you did not have the right employees, what areas did this impact?

Why is an annual corporate check-up so important?

Of course, since conducting an annual corporate check-up takes time and effort, you may be tempted to skip it. Don’t give in to this temptation! This exercise gives the entire team a chance to step back, take a “big picture” look at what’s been going on, and see things that aren’t always obvious when you’re enmeshed in the day-to-day challenge of running a business.

Want to bring in an outside expert to provide a fresh point of view in the corporate check-up process? Give me a call. As a part-time CFO, this is one of the many services that I provide.

In business, as in life, there are “good” surprises and there are “bad” surprises. Winning an unexpected award is good. Discovering that you’re not in compliance with an important regulation is not.

Over the years I’ve seen that many undesirable situations arise because of poor planning, inadequate oversight and controls, and so forth. For example:

Your reported earnings require significant downward adjustments. This is often caused by under-accruing for vacation or holiday pay, bad debts, or your self-insurance reserve. This can happen when (a) someone is cooking the books, or (b) the person handling your financials does not have the expertise to get it right.

• The value of your inventory is grossly overstated. Sometimes this is caused by not having a reliable perpetual inventory system (see “5 Signs that You Need Better Financial Controls”). In many industries, obsolescence is a big issue. Electronics that were fully sellable two years ago at full price may be fairly worthless now. Your financials need to reflect this.

• Your strategic plan did not adequately plan for your growth. Now you’ve got a huge order that you can’t fulfill or you’re sitting on the sidelines watching your competitors take advantage of new market opportunities that you can’t, because you don’t have the resources to do so.

• You’re blindsided by technical obsolescence issues. You failed to plan for the fact that many aspects of your business can be affected by technological changes. For example, obsolete IT systems can become unreliable or inadequate, resulting in a significant negative impact on your operations. Your product and/or product delivery system can become obsolete. If you were selling music via CDs and didn’t see the MP3s coming—or were relying on MP3s and didn’t see the streaming paradigm coming—your sales would take quite a hit.

• You’re losing money on every sale. You could be buying something for $110 and selling it for $105, thinking that you bought it at $90. How can this happen? Not issuing purchase orders can do it. A manufacturer that is using cost accounting standards can also incur this result. Quite often, your actual numbers for raw materials, labor, overhead, etc., turn out to be higher than the standards upon which your cost numbers are based.

Need help ensuring that you’ve got the right people and systems in place to avoid these types of unpleasant surprises? Give me a call. As your part-time CFO, I have the expertise you need.

When a company is first starting out, it is common for the owner/CEO to make nearly all of the decisions. But as a company grows, this approach becomes completely unworkable. Not only is it just too much for one person to tackle, it’s really not the best use of the CEO’s time. Delegating many of the day-to-day decisions to members of lower, middle and upper management becomes a must.

Why establish formal policies and procedures?

Delegation, of course, involves a certain level of risk. How do you ensure that decisions and approvals are made and given in a manner that is consistent with the goals and values of senior management—and in compliance with all applicable laws and regulations—without requiring senior management to be tied up with routine decisions? You establish policies and procedures.

Policies and procedures ensure consistency. They can mean the difference between order and chaos, and compliance and noncompliance. They can also save a great deal of time for everyone involved. After all, when everyone understands the guidelines, decision-making becomes easier.

Establishing appropriate policies and procedures

Depending on the nature of the business, there are a wide variety of policies and procedures to establish. These include:

Sales & pricing – Determining minimum order size and minimum acceptable profit on an order

Extending credit – Evaluating a potential customer’s credit; issuing credit memos

Purchasing – Creating purchase orders; opening accounts with new vendors; approving invoices for payment

Human resources – Establishing employee pay rates and pay increases; allowing use of company vehicles and credit cards

Managerial approvals – Approving expense reimbursements; authorizing corporate travel; signing checks

Legal – Archiving and retaining everything from emails to contracts to financial records

Marketing – Ensuring branding consistency; establishing who is allowed to publicly represent the company to the media

IT – Creating an escalation system; requiring system documentation; ensuring backups take place

Communicating the policies and procedures

It is vital that the policies be written and available for people to see. This can mean putting things in print, uploading them to a corporate wiki, or using some other type of digital document sharing system. For some policies, such as HR-related policies, you’ll want to give each employee a copy in writing and have them sign documentation stating that they’re aware of and have reviewed the policies.

Need help creating policies and procedures that make sense? Give me a call. As a part-time CFO, I’m here for you!

Having a strategic plan in place for your business is the best way to ensure you achieve your goals. After all, if you’re failing to plan, you’re planning to fail. That said, it’s not enough to create a strategic plan. You need to be sure that your strategic plan is not created in a way that will pretty much guarantee it won’t work.

Here are 12 things to watch out for:

1. Having unobtainable goals based on pie-in-the-sky projections.

2. Setting unrealistic budgets that don’t cover actual costs and needs.

3. Failing to create action plans for implementing the strategies and tactics described in the strategic plan.

4. Not getting buy-in from the people who will do or oversee the work.

5. Failing to communicate the vision and strategic objectives to the “rank and file” within the company, or to communicate progress over time.

6. Not assigning responsibilities for each step, and not assigning due dates and timelines.

7. Not planning for the infrastructure needed to accomplish the goals laid out in the plan, such as:

a. People

b. Funds

c. Machinery

d. Physical space

e. Ability to obtain materials, parts or products

f. Production capacity

g. And more

8. Not budgeting for mandated wage increases caused by contractual obligations or increases in the minimum wage.

9. Not doing your homework, such as to determine the actual viability of entering new markets.

10. Not planning for proper marketing and sales support for a new product launch.

11. Not taking steps to avoid scaring customers away with poor customer service, negative press, etc.

12. Taking a “set it and forget it” approach to the strategic plan, rather than following up at regular intervals to ensure it’s being implemented as anticipated.

Want to bring in an outside expert to help you create a strategic plan that makes sense? Give me a call. As a part-time CFO, this is one of the many services that I provide.

The monthly financial reports that most companies issue and review are a great way to keep tabs on how the business is doing. However, for most organizations, reviewing financial data once a month is really not frequent enough. If a problem is brewing, you might not see it until it’s too late to change course.

Financial dashboards, which can be created on a project- or company-wide basis, fill in this gap. Usually set for weekly data, they give management a clear, high-level snapshot of current performance.

Your financial dashboard is used to track things that are easily measured and convertible into a key metric. While they’re most useful if you have a budget to which the numbers can be compared, they’re still helpful even if you don’t.

What to Include on a Company-Based Financial Dashboard

For a company-wide financial dashboard you might want to include the following metrics for that week:

• A/R collections: actual versus budget

• A/R aging: actual versus budget

• A/P payments made: actual versus budget

• A/P aging: actual versus budget

• Payroll expense: actual versus budget

• Full Time Equivalent (FTE) employees: actual versus last week and versus budget (useful for companies where labor fluctuates weekly)

• Cash balances: actual versus last week and versus budget

What to Include on a Project-Based Dashboard

As this will vary greatly based on the industry, I’ll present some possibilities for a construction firm. Here the idea is to track job progress by hours of work completed, and then support that by a measurement of where the project actually stands.

• Actual labor hours

• % of project completed based on labor hours (i.e. actual labor hours divided by total budgeted hours for the project)

• Metric to measure work that was done, actual versus plan. For example, if you’re building a block wall, how many blocks were installed this week? How many blocks will there be in the entire wall?

• % of project completed based on work actually done (i.e. the metric that measures the work that was done divided by the metric representing the entire project)

• Actual labor costs versus budgeted labor costs for this stage of the project. If the project is 72% done, have you burned through more than 72% of the allotted labor budget?

Need help getting a financial dashboard set up for your company? Give me a call! As your on-call CFO, this is one of the many services I can provide for you.

This is the third and final installment in my series on how to review your year-end financial statements like a seasoned pro. So far we’ve looked at your Statement of Cash Flow and your Income Statement. Now it’s time to examine your other key financial statement, your Balance Sheet.

Your Balance Sheet provides a snapshot of your business’ financial condition at a specific moment in time – in this case, your fiscal year-end. It shows your firm’s assets, liabilities and owners’ or stockholders’ equity.

Compare to Last Year

Just like when evaluating your Income Statement, your starting point in understanding the picture that your Balance Sheet is painting about your business is to compare it to the prior year. Take a close look at:

• Cash – Did cash go up or down? Do the numbers match what’s on your Statement of Cash Flows? If not, an accounting error has been made somewhere…most likely in the Statement of Cash Flows, which can be tricky to compile.

• Working Capital – Working capital is your current assets minus your current liabilities. Is it positive or negative? Did it increase or decrease as compared to last year?

Look at Important Ratios

Next there are two important ratios that you should review:

• Current Ratio – The Current Ratio is the ratio of current assets to current liabilities. This provides an indication of your company’s liquidity and ability to pay back its liabilities.

Ideally, the Current Ratio will be stronger than 2:1. A ratio of 1:1 indicates that your company barely has the ability to meet its anticipated debts for the next 12 months. A ratio of less than 1:1 is usually a sign that your company is not in good financial health.

• Leverage Ratio – The “Leverage Ratio” is the ratio of debt to equity. Banks look at this ratio when deciding whether or not to approve a loan.

A ratio of 4:1 or above is considered highly leveraged.

A ratio of 2:1 or less is ideal. This indicates that your company has the ability to safely borrow additional debt.

A ratio of 2.5:1 or 3:1 is in the upper limits of most banks’ “safe zone.” Borrowing money at this point is possible but more difficult.

Conclusion

If you’ve been following this series you now know the secrets to evaluating your year-end financial statements. Of course, if you need any help with any of this, give me a call. As your part-time CFO, I’m here for you.

In my last article I discussed how to review your Statement of Cash Flows. Today we’ll look at your Income Statement, also known as your Profit & Loss (P&L) Statement. Then, in the final article in this series, I’ll explain how to evaluate your year-end Balance Sheet.

Of course, these tips apply whether you’re reviewing your own company’s financial statements or you’re looking at another company’s information – such as the financial statements for a customer that has applied for credit.

Comparisons Can Be Very Helpful

A good starting point is to compare the year-end Income Statement to that of the prior year. If you’re reviewing your own company’s financials, you should also compare it to budget.

Here are some of the first things you should look at:

• Is the revenue going up or down?

• Are the gross profit margins increasing, decreasing or flat?

• Are operating expenses moving as you would expect based on the changes in revenue?

• How did actual performance compare with the budget forecast?

Understand What Happened During the Year

Reviewing an Income Statement is not just a matter of seeing if the numbers look “about right” and moving on. You also need to ask questions to understand what happened during that time period. These include:

• What’s driving the change (or lack of change) in gross profit margins?

• If operating expenses are not moving in tandem with revenue, why not? If expenses are rapidly accelerating, what’s driving it? If cost-cutting measures slashed expenses, how are these measures affecting operations?

• Were there any unusual or non-recurring expenses? How would the Income Statement look if you pulled the one-time expenses out of the picture?

Be Sure to Look Forward, Too

Next you want to ask about how the events of the past year will likely impact the company going forward. For example:

• Is it anticipated that the current levels of revenues, operating expenses and gross profits will continue in each of the next four quarters? Why or why not?

• Are the needed credit facilities in place to support operations and/or anticipated growth? As I have discussed in the past, you need to avoid growing yourself out of business."

• How are vendor relations? Are there any potential supply issues that could affect operations?

I also like to ask divisional managers what two things could be changed in company operations to increase bottom-line profit. The answers can be very revealing!

Much more than “just” a “numbers person,” a CFO is a business person with many skills – including the ability to analyze your numbers and help you make informed decisions based on this data. If your business is growing, you don’t have to wait until you need a full-time CFO to start reaping the benefits of a CFO’s expertise. You can bring in a part-time CFO like me right now!

Even working on just a part-time basis, there’s a lot that a CFO can do that will have a significant impact on your business’ success, including:

1. Develop a strategic plan to achieve your goals – What

are your goals for the next 12 months? Does your management team have a

workable plan to make them happen, or is everyone just showing up and

hoping for the best?

2. Understand if you’re adding value to your company –

Are your financial ratios improving? If so, you may be able to get

better interest rates, larger credit limits on your trade payables, and

more money when you sell the company.

3. Analyze and strengthen your customer base – As I discussed in a previous article

, some customers bring a lot more to your bottom line than others. Take

a close look at your margins by customer, especially your largest

volume customers. Take steps to up-sell higher-margin products to your

lower-margin customers. Reduce customer-caused fire drills overall. And

consider firing your least profitable customers.

4. Ensure you’re getting the best prices – Are you getting the best prices from all of your vendors? When was the last time you got competitive quotes on your top 10 spending line items aside from labor? And speaking of labor, do you participate in industry wage studies, such as those done by your trade association? Are you paying a competitive wage? Are you paying too much for your brother-in-law, or about to lose a great employee because you’re paying less than the going rate?

5. Identify and eliminate wasteful spending –

This often involves looking at the “miscellaneous” expense category,

which is usually either money that should not have been spent, or things

that only benefit the executives. Sometimes it’s the owner’s “slush

fund” – but the owner has no idea where the money is going.

The bottom Line is, an experienced CFO can make a significant difference for your bottom Line.

- ← Previous

- 1

- 2

- 3

- 4 (current)

- Next →